Banking & Regulatory Services

The importance of managing risk has never been more apparent. The market is seeing a wave of new and emerging markets which requires experience and knowledge.

We can advise on the practical effects of both national and international regulatory trends, providing advice on the structuring of transactions, new products and services.

The team at ISOLAS advises both local and major international banks and other regulated entities on a vast array of matters, including licensing and regulatory issues, lending and day-to-day banking requirements.

This incorporates ISOLAS’ dedicated MiFID team, who have been instrumental in a large number of regulated entities achieving MiFID compliance within the relevant time frames.

We regularly advise banks on the provisions and changes effected by the Payment Services Directive.

The team not only understands the Gibraltar financial services industry, but also brings an international perspective that accommodates today’s increasingly common cross-border nature of banking and financial services transactions.

Expertise

Our expertise also includes:

- Advising on bank mergers and acquisitions

- Lending and security documentation

Litigation

We also have a banking litigation team, should a dispute arise, including:

- Lender liability

- Tracing claims

- Injunctions and freezing orders

- Fraud and anti-money laundering

More insights View all news and insights

24/07/2024 NewsISOLAS LLP Contributes to Chambers Corporate Governance 2024 Guide

Read more

ISOLAS LLP Contributes to Chambers Corporate Governance 2024 Guide

19/07/2024 NewsDr Jamie Trinidad KC appointed Beacon Professor at the University of Gibraltar.

Read more

Dr Jamie Trinidad KC appointed Beacon Professor at the University of Gibraltar.

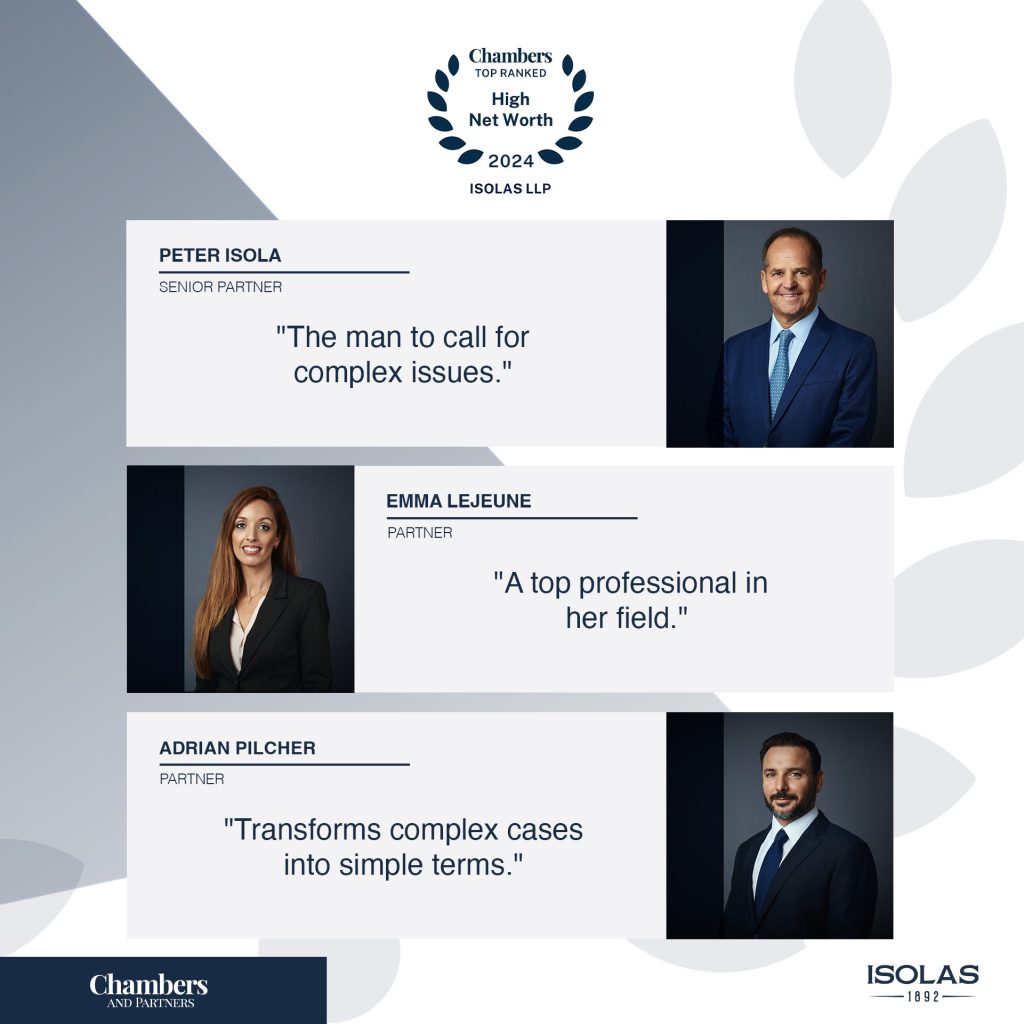

18/07/2024 NewsISOLAS Retains Band 1 Ranking in Chambers and Partners High Net Worth Guide

Read more

ISOLAS Retains Band 1 Ranking in Chambers and Partners High Net Worth Guide

12/07/2024 NewsISOLAS LLP CONTRIBUTES TO CHAMBERS CORPORATE TAX 2024 GUIDE

Read more

ISOLAS LLP CONTRIBUTES TO CHAMBERS CORPORATE TAX 2024 GUIDE